This S Corp vs LLC tax calculator is designed to show the tax differences between S Corp and LLC business structures. It can help you figure out your payroll and self-employment tax savings. Let’s explore it!

How LLCs are Taxed?

Any profit of an LLC is passed to the owners; this process is known as “Pass-through entities.” In other words, the LLC itself doesn’t pay any federal taxes as the owners take it out. Afterward, it is considered the owner’s personal taxable income, and they pay taxes based on the regular tax bracket.

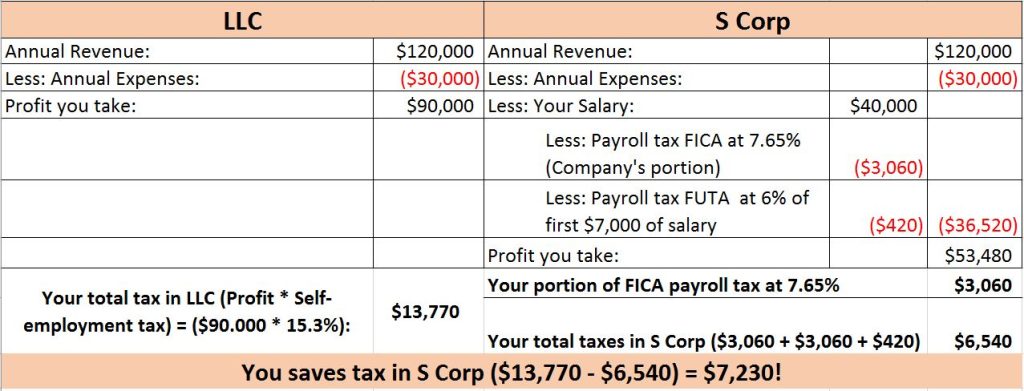

To find the profit of an LLC, we subtract the annual business expenses from the annual revenue. After that, the owners must pay the federal self-employment tax of 15.3% on their salary.

How the S Corporation are Taxed?

After incorporating your business as a S Corporation you can pay yourself a reasonable salary. Then you have to pay regular payroll taxes of the employee’s portion based on a given rate. The current payroll tax (FICA) is 7.65% of the total salary and the payroll tax FUTA (Federal Unemployment Tax) is 6% of the first $7000 of your salary. This means you only pay the payroll taxes of the employee’s portion of your salary if you incorporate S Corp.

So that the great advantage of S Corp is you only pay the payroll taxes on your salary but not on the profit you gained. The profit you made from an S Corp will be added to your taxable income without incurring any corporate taxes.

Benefits of Incorporating S Corp

You could reduce your corporate tax liability by using the S Corporation tax status. S Corp lets you give yourself a reasonable salary for your business. And other profit you take from business is tax-free in S Corp. But in an LLC, you have to pay a federal self-employment tax at the current rate of 15.3% on your profit. So can you imagine the tax differences?

Let’s do an example calculation of LLC vs S Corp taxes:

Suppose your business generates $120,000 yearly revenue in both LLC and S Corp status. Both have a yearly expense of $30,000 and the S Corp gives you a reasonable salary of $40,000 annually. You take profit from LLC and S Corp is $90,000 and $50,000 respectively. Let’s calculate the taxes in both scenarios.

Using the S Corp vs LLC Tax Calculator

The S Corp vs LLC Tax Calculator allows you to directly compare the tax impact between an S Corporation and an LLC. Just enter these three pieces of information and hit calculate.

- Enter Total Annual Revenue for LLC and S Corp: We use the same annual revenue for both business structures to simplify the calculation.

- Input Salary for S Corporation: Enter the annual salary you plan to pay yourself if you choose the S Corporation structure. This is needed to calculate the payroll taxes.

- Add Business Expenses for both LLC and S Corp: List any deductible expenses associated with running your LLC & S Corp. We use the same business expenses for a simple comparison of taxes.

- As you click on the “Calculate” button, the calculator will display:

- Total Taxes in S Corp: This includes FICA (7.65%) and FUTA (6% on the first $7,000) payroll taxes on the salary you pay yourself.

- Total Taxes in LLC: This includes the 15.3% self-employment tax on your LLC’s net income (after expenses).

- Tax Difference: The difference between the total tax liabilities of an S Corp and LLC, helps you see the potential tax savings of each option.

Please note that this calculator does consider your federal income taxes. This is only to give you an idea of how you can avoid additional payroll taxes by incorporating your business as an S Corp or S Corporation.