Calculating days in accounts receivable helps businesses measure the average number of days it takes to collect payments from customers. It’s a key metric for assessing liquidity and efficiency in credit and cash flow management. This web calculator helps you to determine the average accounts receivable collection period.

Account Receivable Days Calculator

Formula for Accounts Receivable Collection Period

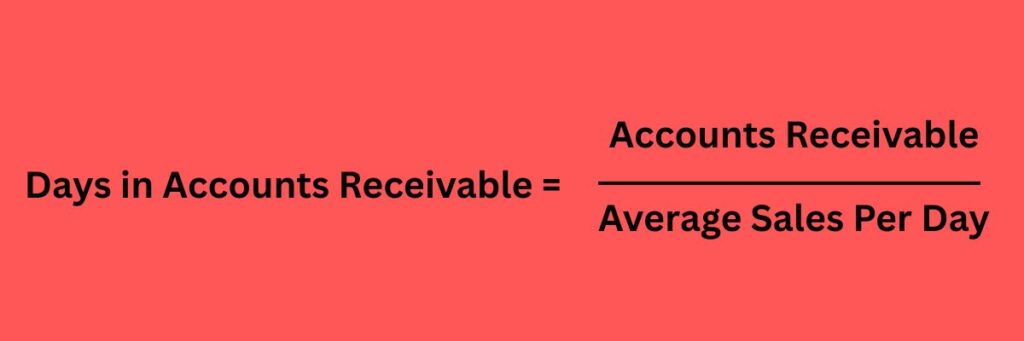

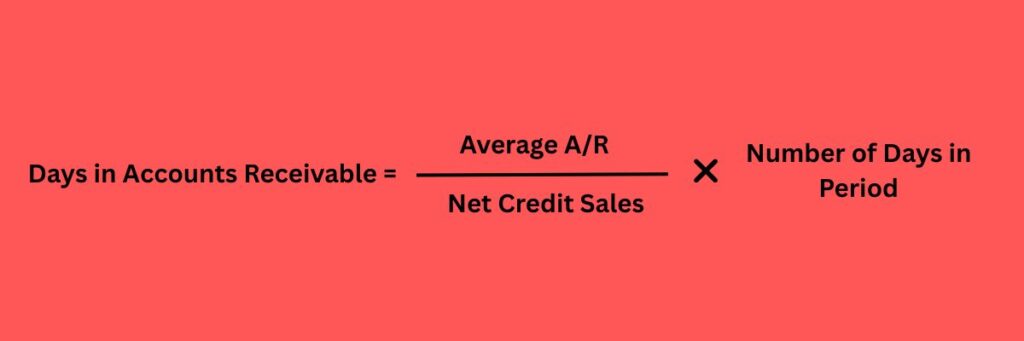

There are basically two different formulas we can use to calculate the days in accounts receivable.

Formula- 1:

Formula-2:

Calculate average accounts receivable as, Average A/R = (Beginning A/R + Ending A/R) / 2

Those metric helps businesses optimize credit policies and improve cash flow management.

Importance of Calculating Accounts Receivable Days

The Days in Accounts Receivable (AR Days) metric is very important metric in financial analysis. It helps businesses assess their cash flow efficiency, credit policies, and overall financial health. Here’s why it matters:

1. Measures Cash Flow Efficiency

- AR Days shows how quickly a company collects payments.

- A lower number means faster collections, improving liquidity and working capital.

- A higher number indicates delayed payments, which can strain cash flow.

2. Evaluates Credit & Collection Policies

- Helps businesses determine if their credit terms (e.g., Net 30, Net 60) are effective.

- If AR Days exceed payment terms (e.g., customers take 45 days on Net 30 terms), it signals:

- Your credit screening is poor

- your collections process is inefficient

- Customers delaying payments without any reasons

3. Identifies Potential Bad Debts

- A rising trend in AR Days may indicate:

- Customers struggling to pay (increased default risk).

- Your collections efforts is ineffective.

- Helps detect delinquent accounts early before they become bad debts.

4. Benchmarks Performance

- Companies compare AR Days against:

- Industry averages (e.g., retail vs. manufacturing).

- Historical trends (improving or worsening over time?).

- A business with lower AR Days than competitors has a cash flow advantage.

5. Supports Financial Planning & Forecasting

- Helps predict future cash inflows for budgeting and expenses.

- You have to always ensures the business has enough liquidity to cover:

- Payroll

- Supplier payments

- Short term loan obligations

6. Improves Investor & Lender Confidence

- Lenders and investors review AR Days to assess:

- How efficiently the company manages receivables.

- Risk of insufficient cash flow.

- A stable or improving AR Days ratio makes the business more creditworthy.

7. Highlights Billing & Invoicing Issues

- If AR Days are high, the problem could be:

- Late invoicing.

- Errors in billing.

- Poor payment reminder systems.

- Fixing these issues can speed up collections.

Conclusion

Businesses that track and optimize AR Days maintain healthier finances and avoid liquidity crises. It gives you an idea of how long you have to wait to liquefied your accounts receivable. So you can always track and control your credit sales. I hope you find this calculator useful!